Market research is an essential way to gain insights from your target audience about new products and services. These insights save you time, money, and frustration. They also keep you from making the #1 mistake of product development: going to market with a product that no one will buy.

Market research panels are used to check the pulse of employees, gather public opinions on emerging topics, or benchmark a company’s performance against industry competitors. These research panels are valuable resources for quickly collecting data from your target audience on what works and what doesn’t. But how does a research panel work and what are the benefits?

What is a research panel?

A research panel is composed of people who represent your target audience. The respondents reflect the demographics of your ideal customer, giving you a sample of insights across age, gender preference, income, purchase behaviors, and other traits.

Research panel respondents fill out a survey that asks specific questions related to your project’s goal. For instance, you might perform concept testing on a new product, a new logo design, or brand messaging to determine if panelists like your ideas.

Before taking the survey, the panel members are vetted to make sure they represent your target audience. This pre-qualification process guarantees that you reach the right groups with your survey and improves your research study’s data quality.

In the past, surveys were conducted via phone or in shopping malls and were limited to collecting one-on-one data. Today, most surveys are conducted using an online panel of pre-qualified participants. Online market research panels allow surveys to be conducted quickly, target a specific audience, and produce cost-effective and high-quality results.

Companies of all sizes use online panels for concept testing, employee feedback, and insights into new market trends. Online panel research can provide both qualitative and quantitative data, depending on the data research methodology used. The panel sample can include panelists from the U.S. or extend globally to other countries to provide a wider variety of insights.

Get the right responses from the right audience

Trust SurveyMonkey's Audience panel for actionable results.

Why is panel research important?

According to Nielsen, over 30,000 consumer products are launched in the U.S. each year. How do you know if your product will stand out in the crowd?

Market research has been used for nearly 100 years to understand the motivations and perceptions of buyers. Surveys first started as a “man on the street” interview and have been refined to ask specific questions to target audiences. The purpose of surveys is still the same, to understand what a target audience wants, but the reach and impact has greatly expanded.

Panel research helps companies avoid expensive failures by gaining customer insights before launching a product. They learn what messaging resonates with customers, how to optimize price points, and how to create packaging that attracts customers.

In addition to market research, online survey panels play an important role across business, academia, government, and media. Businesses often administer surveys to improve employee engagement, while news organizations use surveys to better gauge public opinions about emerging topics.

Panelists are screened in advance, creating a large pool of respondents for an online survey panel. This pool of people are immediately available to respond to market research studies and represent all of the demographics of the target audience.

Research panels offer a diverse set of views that are easily captured in a survey. Panel members self-report their answers, avoiding the bias that may happen if a researcher completes all the data. Because the respondents represent a wide variety of demographics, survey results will include both expected and unexpected answers, bringing valuable insights to the researcher.

Online survey panels save time and money, while reducing the risk that a company will make a big mistake or misinterpret important issues. They also provide quick results that help organizations stay agile and quickly react to market changes.

Launch your product with confidence

Use SurveyMonkey’s Audience panel before you go to market.

When to use a market research panel

Market panel research is flexible enough to meet a variety of research needs. Whether you need a global consumer perspective for your next product launch, concept testing for your brand repositioning, or an in-depth study on a unique topic, internet panel surveys offer a variety of benefits.

You should consider using a market research panel when the following considerations are important to your study:

Frequency: If you are studying consumer reactions or public opinion over time, a market research panel will enable you to kick off a longitudinal research study. This survey approach will reach your same target audience, at different points in time, to see if their opinions or behaviors change. Alternatively, if you need a quick, one time survey, a questionnaire to your target audience will give you immediate results.

Resources: If you are a bootstrapping company trying to launch the next great consumer product or service, you don’t have money to waste on a failed product. When online mattress startup Helix Sleep had an idea for a new pillow, the company needed to know if its customer base would go for it. A consumer research panel provided valuable, budget-friendly insights that evolved the original idea and helped the company create a winning product.

Concept testing: Did you know that over 95% of new products fail? Concept testing helps reduce the high risk of failure. Once you have a brilliant idea, test it. One entrepreneur had an idea for a financial services product for parents with childcare needs, but made sure she tested it before she quit her day job. Her concept did prove to be a hit, but only after she refined it with her target audience.

Specialized subject matter: If you have a product, concept, or service that will only appeal to a small target audience, it can be difficult to find the right pool of people to survey. Because of the large pool of potential respondents, survey companies can give you access to market research panels that are made up of the select group of people that represent your target audience.

In-depth responses: Curious what is on your target audience’s mind? Consumer panels can give you deep insights that go beyond a short questionnaire. From open-ended questions to Likert scale responses, you receive detailed responses about consumer behavior and perceptions. With thoughtful reactions to your concepts, brand, messaging, policies, and trends from your target audience, you can make data-driven decisions with confidence.

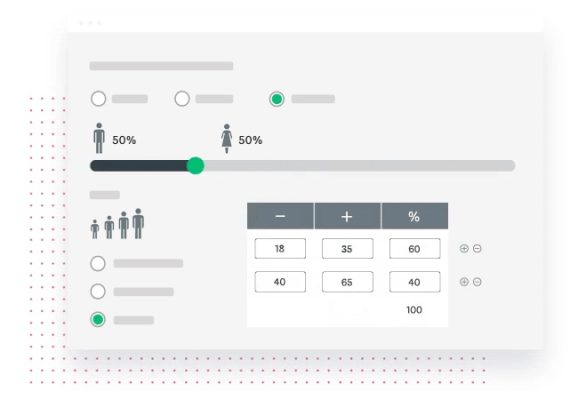

A large, diverse pool of respondents: Some market research studies improve their results by using a large number of responses from a diverse group. Because research panel members are pre-qualified, companies can choose the right number of respondents. With SurveyMonkey Audience, for example, respondents are pre-qualified using over 50 profiled attributes—meaning you can choose your audience based on demographics like age, income, employment, hobbies, and other representative categories.

Expert assistance: If you frequently perform market research, you can create your own pool of survey respondents from customers, prospects, employees, business partners, or students. But you will be responsible for screening those respondents, creating accurate market research questions, compiling answers, and analyzing results. That is why many companies turn to survey companies to use their pre-qualified group of panelists and choose a research methodology that serves their project goals.

Customers and stakeholders have a lot to say. There’s no need to stay in the dark when panel members are just a few clicks away, ready to give you valuable insights.

Want to learn more about conducting your own market research?

Find tips and resources in our Ultimate Guide to Market Research.

Examples of B2B and B2C panel research

The purpose of panel research is to provide meaningful results that lead to improved products and services. Surveys can be conducted for both Business-to-Business (B2B) and Business-to-Consumer (B2C) purposes.

For B2C research, companies want to find out about their customers’ behavior patterns and motivations for buying products. Because these companies are focused on solving customer problems, they often use concept testing, brand awareness, and pricing and marketing messaging surveys to collect relevant insights.

B2C survey questions might include:

- How would you rate the value for the money for this product?

- If the product were available today, would you buy the product?

- Which of the following brands have you heard of?

- Which online retailers do you most often use?

- What draws your eye on this package?

It’s never been more important to run a client-centric business focused on solving customer problems. B2C panel research provides unique insights that show what customers want and what their motivations are for buying.

For B2B research, surveys are designed to uncover business information and behavior. They may ask questions about annual revenue, profits and financial projections for the coming year. They may also survey business leaders to uncover marketplace trends or ask suppliers about their experience working with them to uncover competitive advantages or gaps.

The Net Promoter Score, NPS®, is one type of B2B survey that evaluates the effectiveness of a company as they serve their customers and business partners. NPS is a highly regarded loyalty metric that is simple, quick, standardized, quantifiable, and benchmarkable.

The B2B NPS survey questions include:

- How likely is it that you would recommend this company to a friend or colleague?

- What does this company do really well?

- What was missing or disappointing in your experience with us?

- How can we improve your experience?

- What is the one thing we could do to make you happier?

Businesses are dependent on their suppliers and business partners to stay in business. These stakeholder groups are often just as important as their customers when it comes to service and performance. Tapping into their insights with a NPS survey helps organizations find performance gaps and market weaknesses before they become a problem.

Example #1: Better messaging, faster B2B sales cycle

Software makes companies more efficient. But what if the software vendor’s messaging can’t be understood by its corporate clients?

That is the issue one SaaS based company faced. Apptio had jargon-filled marketing messaging, a long sales cycle, and a cumbersome process to collect customer testimonials that proved its software made life better for B2B clients.

The software company used B2B feedback surveys, along with advanced tools, to create a brand message that made it easier to sell, shortening the sales cycle by 25%.

Example #2: Panel research shows how to sell to millennials

How does a nearly 60-year-old financial institution reposition themselves to sell to tech-savvy millennials? That was the challenge that Raymond James, the multinational investment bank with nearly 19,000 employees, wanted to tackle. It turned to an online consumer panel to find out how to reach its target audience.

Surveying 400 customers in 2 days uncovered 12 investor insights that showed Raymond James which social media channels it could leverage to better sell to millennial customers. It found surveys to be a fast, cost-effective way to get unexpected consumer insights that could be used to improve the bottom line.

Example #3: Surveys influence future products and services of software giant

Some large companies are building their own pool of pre-qualified respondents for panel research. For example, Microsoft taps into its Microsoft Partner network of consulting and software firms that use its software solutions.

With the help of panel responses, Microsoft uses surveys and feedback to improve the partner experience and influence the development of its Partner Network resources, offers, and programs—including playbooks used by partners on all continents.

The surveys also provide insight into the global partnerships ecosystem. “We can’t overstate the value of a panel,” says Microsoft. “Moreover, it’s a great way to ensure your thoughts are heard by our leadership and teams!”

What are the benefits of a market research panel?

Market research panels provide quick responses from a large pool of candidates about specific issues. The survey results are put to immediate use by organizations across the globe, improving the customer experience, increasing employee engagement, and uncovering audience motivations.

1. Fast insights, reduced risk

From a few hours to just a few days, companies of all sizes receive quick insights and feedback using online survey panels. Using survey respondents that represent your target audience, you’ll get insights you can put into action, saving you time and money. Remember, most product launches fail. Having the right research about what customers really want will reduce your market risk, help you improve your product, or allow you to revise your messaging so your product stands out.

2. Target your audience from a large respondent pool

Survey companies have access to a large pool of respondents, both domestic and international, that represent your target customer. Panel members are motivated and quick to respond with accurate insights. Below are a few examples of people you can send your survey to using SurveyMonkey's Audience panel:

General Population (Medium Sample)

- All Genders (Census)

- All Ages (Full Census)

- All Incomes

- 500 Responses, United States (USA) - SurveyMonkey

Full-Time Employees

- All Genders (Census)

- All Ages (Basic Census)

- All Incomes

- Employed Full-time

- 250 Responses, United States (USA) - SurveyMonkey

Consumer Shoppers

- All Genders (Census)

- All Ages (Basic Census)

- All Incomes

- Primary Decision Maker in Household

- 250 Responses, United States (USA) - SurveyMonkey

Tapping into the perceptions and motivations of your target audience will help you design a successful go-to-market strategy with the right product, logo, messaging, and pricing. An online panel also provides an objective source of opinions about your research study topic.

3. The most cost-effective market research

Some traditional research methods are difficult to execute in today’s market. Phone surveys, in-store focus groups, and other one-to-one research methods can be expensive and time consuming.

Online consumer panels provide immediate responses and valuable insights for a far lower cost than traditional research methods. In addition, you can rely on the research methodology and data quality you receive from panel research.

Who uses market research panels?

Market research companies use online survey panels extensively for their B2C and B2B clients who need information on concept testing, product launches, brand positioning, pricing, logo testing and more.

Individual companies use research panels to conduct extensive market research within their company. Surveys are also used for employee insights that improve engagement and performance.

Universities and colleges use market research panels to understand their student population’s opinions and perspectives. Students and researchers also use online panel research for academic papers and research.

Professional organizations of all types also use panel research to stay connected with their membership base, understand how they can better serve their members, and remain engaged.

News organizations frequently use surveys to tap into the power of their audience and gain insights on current trends, perspectives, and behaviors.

Panel research with SurveyMonkey

SurveyMonkey is a leader in panel research. SurveyMonkey’s Audience panel finds survey panelists for over 1,500 projects every month, helping our customers collect over 100,000 responses every week.

To begin a survey, you start by selecting the demographics of your target audience and how many responses you want to receive. Choose a pre-designed, proven template for the type of research you want to perform, and Survey Monkey takes care of the rest.

We go to great lengths to make sure you receive quality data you can trust, along with analytics and reporting that are easy to read and actionable. We are constantly updating our pool of qualified respondents to make sure you have the audience that best reflects your target customers.

SurveyMonkey is known for quick, cost-effective results that help you make better decisions. If you need a one-time survey or a long-term longitudinal study, we have the panelists, templates, and reporting you need for your next market research study.

Ready for powerful panel research?

SurveyMonkey Audience simplifies the survey process with high-impact results.

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting